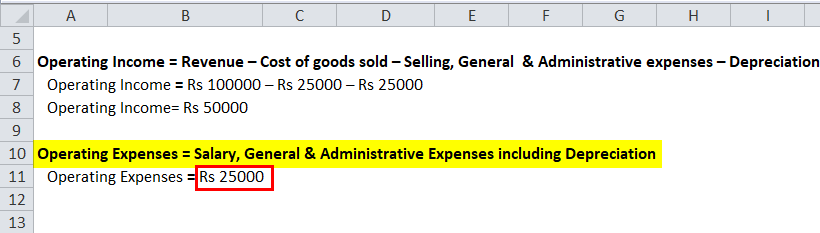

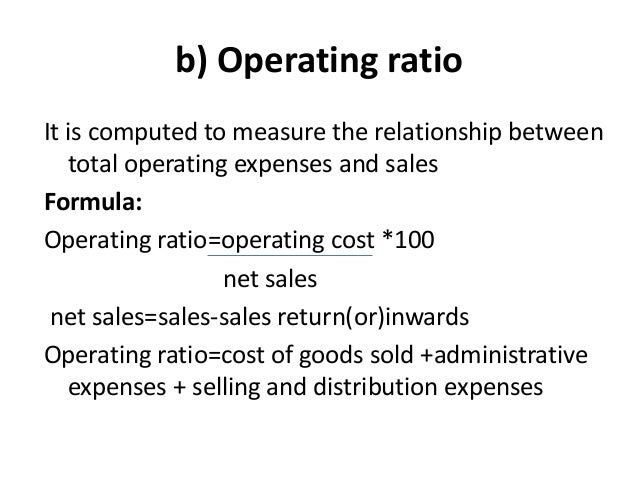

While the concepts discussed herein are intended to help business owners understand general accounting concepts, always speak with a CPA regarding your particular financial situation. Therefore, the information available via this website and courses should not be considered current, complete or exhaustive, nor should you rely on such information for a particular course of conduct for an accounting or tax scenario. If we compare the ratio with the other companies in the same industry, we will be able to interpret the OER properly. Tax and accounting rules and information change regularly. Using the operating expense ratio formula, we get OER Operating Expenses / Revenues Or, 40,000 / 400,000 10. Year 1 revenue (cell D3) 40,000 Sales and marketing expense (cell D8) Revenue (cell D3) x 10 Sales and marketing expense 40,000 x 10 Sales and marketing expense 4,000 The operating expense formula to enter in cell D8 in this case is D310.

Reliance on any information provided on this site or courses is solely at your own risk.

#Operating expenses formula professional

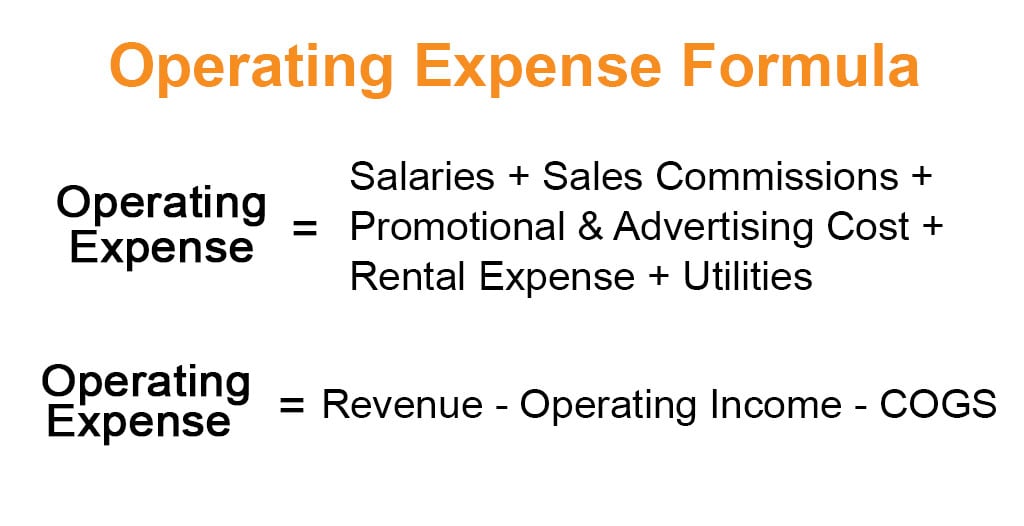

Accounting practices, tax laws, and regulations vary from jurisdiction to jurisdiction, so speak with a local accounting professional regarding your business. The content is not intended as advice for a specific accounting situation or as a substitute for professional advice from a licensed CPA. Typically, expenses are divided into three groups: personnel costs, other operating expenses and overheads, also known as ' OPEX' (leases, advertising, water, electricity and gas supplies, IT, among other costs) and depreciation. The content provided on and accompanying courses is intended for educational and informational purposes only to help business owners understand general accounting issues. These are the expenses that an institution incurs in its business operations.

0 kommentar(er)

0 kommentar(er)